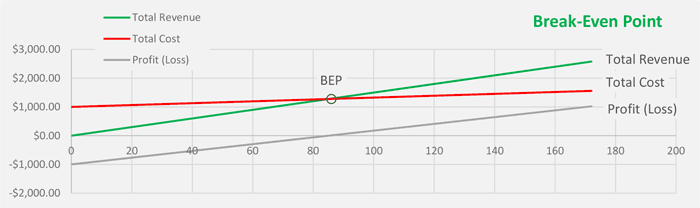

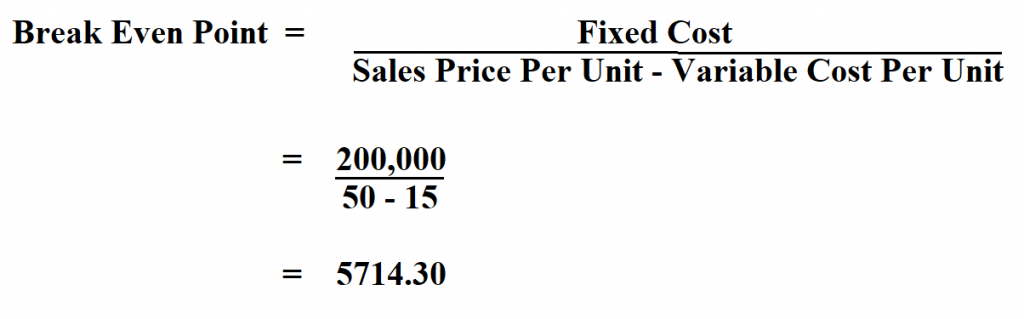

Variable costs are the costs that vary depending on sales volumes these include things like raw materials. Fixed Costsįixed costs exist no matter how much you sell or don’t sell these include costs like rent, power, insurance, and wages. It’s calculated by reviewing your fixed costs, variable costs and price. This will allow you to evaluate the viability of your business and enable you to locate areas where efficiency and profitability can be improved. By knowing your break-even point you can determine how many units you need to sell to cover your costs. Put simply ‘break-even’ is the point at which your revenues cover your expenses. You could consider negotiating with suppliers for lower material costs, finding more affordable equipment, or streamlining processes to increase efficiency and reduce labor costs.īy keeping a close eye on your break even point and making strategic decisions about cost control, you’ll be better positioned to improve your overall profitability.helps in managing financial risks by identifying potential cash flow issues and taking proactive measures to mitigate them.Knowing your break-even point is important for setting goals for your business. If your break even point is too high, it may indicate that you need to find ways to reduce your costs.

The break even point can also be used as a benchmark for making decisions about controlling costs.

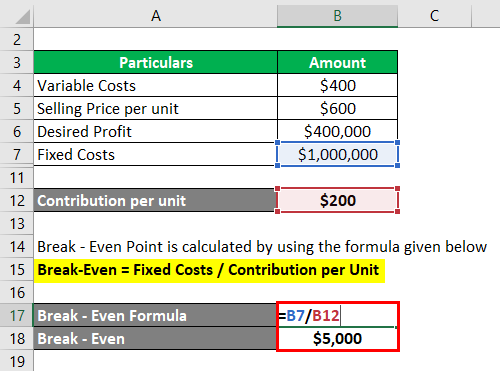

Identify areas where you can control costs and reduce expenses to improve profitability When was the last time your reviewed your pricing and increased them? We have an article that shares our method for increasing prices without upsetting your customers here. By knowing how many units you need to sell to break even, you can set prices that allow you to achieve profitability while still being attractive to your target market. Pricing is a delicate balance between covering your costs and remaining competitive in your market. Can you increase your higher value services or products? Take a look at some of your overheads – are you able reduce your costs anywhere? When was the last time you had a look at your utility bills? Run your business by the same standards you live by in your home, and make sure that you’re comparing costs to find the fairest price. Set your targets (we have a blog on how set key performance indicators and targets here) to reflect this. Effectively to break even for the year, you need to make a bigger profit in some months to compensate for the loss in others. If you have established that 35% of your turnover is made in the run up to Christmas, then your break even point for that quarter should be 35% of your annual target. Most businesses are seasonable to some degree, so dividing the break even point by 12 will likely not give you an appropriate monthly target. Here’s a few of our tips on what you can do once you have your figure: 1. Once you have your break even point, you need to use it to make those all important business decisions to help your business recover, overcome challenges and dips, or push for growth. That’s why we’re here, armed with calculators, a long-lasting history with spreadsheets, and plenty of experience helping businesses like yours. Struggling to make the calculation? Don’t worry! Few business owners are confident enough to try and calculate their own break even point. Total costs/Gross Profit Margin = Break Even Point.Note: We can help you to figure out which costs are direct costs and which are overheads. Work out your Gross Profit Margin (The percentage of profit that you make on each sale of your service or product after deducting the cost of producing it, known as “direct costs”).Your calculation must be realistic and include a contingency figure for price increase and unforeseen costs. Your Gross Drawings + Overheads (i.e general running costs of the business) = Total Costs.First, calculate what you need to take home in order to meet all your living costs + the tax you are likely to pay on this sum = this is your gross drawings.

0 kommentar(er)

0 kommentar(er)